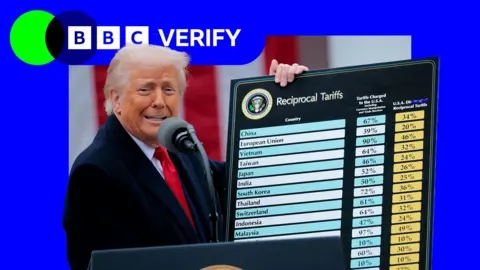

Since the reintroduction of aggressive trade measures earlier this year, the U.S. has significantly altered its import tax structure, leading to higher government revenue but also sparking economic ripple effects worldwide.

Sharp Rise in Tariff Revenue

Recent data indicates that the average U.S. tariff rate on imported goods has surged to 18.2%, the highest level in nearly a century. This marks a dramatic increase from the 2.4% rate recorded before the policy shift. As a result, federal tariff collections have tripled, reaching $28 billion in June alone. Analysts suggest these measures could reduce government borrowing by $2.5 trillion over the next decade. However, critics argue that the economic drag caused by these tariffs may outweigh the fiscal benefits.

Mixed Results on Trade Deficit

A key goal of the policy was to narrow the U.S. trade deficit by discouraging imports and encouraging exports. Yet, preliminary figures reveal an unexpected outcome: the trade gap has widened, hitting a record $162 billion earlier this year before moderating slightly. Economists attribute this to businesses stockpiling foreign goods ahead of tariff implementation. While imports surged, exports saw only marginal growth, undermining the intended rebalancing effect.

China’s Trade Shifts

The policy has notably impacted trade with China, where exports to the U.S. dropped by 11% in the first half of the year. However, Chinese firms have redirected sales to other markets, with exports to India, the EU, and Southeast Asia rising significantly. Some experts suggest that Chinese manufacturers may be circumventing tariffs by routing goods through neighboring countries—a tactic seen in previous trade disputes.

Global Trade Realignments

Other nations have responded by forging new trade alliances. The UK and India finalized a long-pending agreement, while European and Latin American blocs deepened economic ties. Meanwhile, China has reduced its reliance on U.S. agricultural products, turning instead to Brazilian soybean suppliers—a shift accelerated by retaliatory tariffs.

Domestic Price Pressures Emerge

While U.S. inflation remains relatively stable, early signs suggest that tariffs are beginning to affect consumer prices. Certain imported goods, including electronics and household appliances, have seen noticeable price hikes. Economists warn that as stockpiles dwindle, further increases could follow, potentially straining household budgets.

As the global trade landscape continues to evolve, the long-term consequences of these policies—both for the U.S. and its trading partners—remain uncertain.